Impact of Interest Rate Changes on the Economy: Federal Reserve Interest Rates

Federal reserve interest rates – Interest rates are one of the most important tools that the Federal Reserve uses to manage the economy. By raising or lowering interest rates, the Fed can influence economic growth, inflation, and unemployment.

The recent hike in federal reserve interest rates has sparked global economic uncertainty. This has had a ripple effect on emerging markets, including Mexico and Brazil. Mexico vs Brazil is a classic rivalry that has intensified in recent years. Both countries are vying for regional dominance and economic supremacy.

The federal reserve interest rate hike has added another layer of complexity to this rivalry, as it could impact their respective economic growth and investment opportunities.

Impact on Economic Growth

When the Fed raises interest rates, it becomes more expensive for businesses to borrow money. This can lead to a decrease in business investment and economic growth. Conversely, when the Fed lowers interest rates, it becomes cheaper for businesses to borrow money. This can lead to an increase in business investment and economic growth.

The Federal Reserve’s interest rate hikes have sent ripples through the economy, affecting everything from mortgages to business investments. But beyond the financial world, these rate hikes have also had a ripple effect on history. In 1971, a plane crash in Lake Champlain claimed the lives of several prominent figures, including Bernard Baruch.

The investigation into the crash revealed that the pilot had been under financial strain due to the rising interest rates, a tragic reminder of the far-reaching consequences of economic policy.

Impact on Inflation

Inflation is the rate at which prices for goods and services increase over time. The Fed can use interest rates to control inflation. When inflation is too high, the Fed can raise interest rates to slow down economic growth and reduce demand for goods and services. This can help to bring inflation under control.

Impact on Unemployment

Unemployment is the rate at which people are out of work. The Fed can use interest rates to influence unemployment. When unemployment is too high, the Fed can lower interest rates to stimulate economic growth and create jobs. Conversely, when unemployment is too low, the Fed can raise interest rates to slow down economic growth and reduce the risk of inflation.

Factors Influencing Interest Rate Decisions

The Federal Reserve considers a range of economic indicators and data points when setting interest rates. These include measures of inflation, unemployment, and economic growth. The Fed’s goal is to maintain price stability and promote maximum employment, and its interest rate decisions are designed to help achieve these objectives.

Inflation

Inflation is a key factor in the Fed’s interest rate decisions. The Fed aims to keep inflation low and stable, as high inflation can erode the value of money and harm economic growth. The Fed uses several measures of inflation, including the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index.

Unemployment, Federal reserve interest rates

The Fed also considers unemployment when setting interest rates. The Fed aims to promote maximum employment, and its interest rate decisions can help to influence the level of unemployment. When unemployment is high, the Fed may lower interest rates to stimulate economic growth and create jobs.

Economic Growth

The Fed also considers economic growth when setting interest rates. The Fed aims to promote sustainable economic growth, and its interest rate decisions can help to influence the pace of growth. When economic growth is slow, the Fed may lower interest rates to stimulate growth.

Market Expectations and Financial Stability

In addition to economic indicators, the Fed also considers market expectations and financial stability when setting interest rates. The Fed wants to avoid surprises in the financial markets, and it may adjust interest rates to help ensure financial stability.

Historical Trends and Future Outlook

Interest rate changes have a significant impact on the economy, affecting everything from consumer spending to business investment. Over the years, the Federal Reserve has implemented various interest rate changes to manage inflation, promote economic growth, and maintain financial stability.

Timeline of Significant Interest Rate Changes

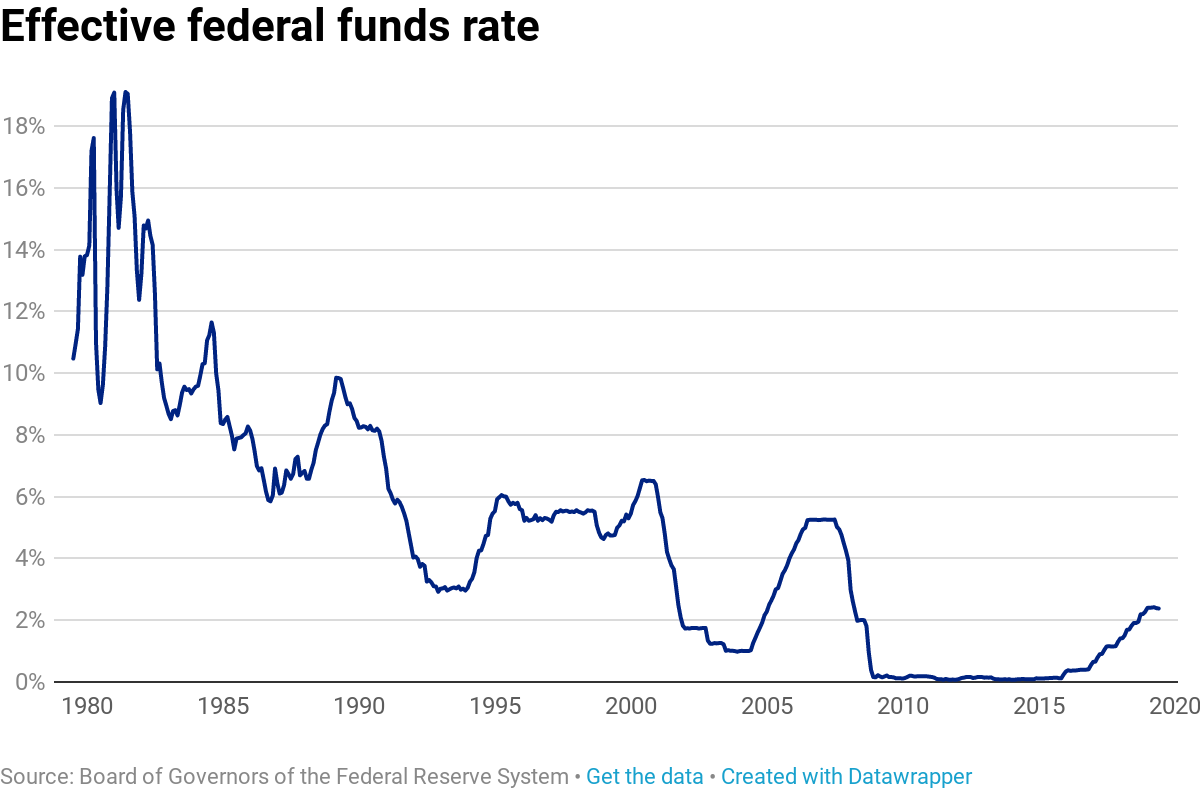

Here is a timeline of some of the most significant federal reserve interest rate changes and their impact on the economy:

- 1979: The Federal Reserve raises interest rates to 20% to combat high inflation. The move triggers a recession.

- 1982: The Federal Reserve lowers interest rates to 8% to stimulate economic growth. The move helps to end the recession.

- 1994: The Federal Reserve raises interest rates to 6% to prevent inflation from rising. The move slows economic growth.

- 2000: The Federal Reserve lowers interest rates to 6.5% to stimulate economic growth. The move helps to prevent a recession.

- 2008: The Federal Reserve lowers interest rates to 0% to prevent a financial crisis. The move helps to stabilize the economy.

- 2015: The Federal Reserve raises interest rates to 0.25% to normalize monetary policy. The move signals the end of the financial crisis.

- 2018: The Federal Reserve raises interest rates to 2.25% to prevent inflation from rising. The move slows economic growth.

- 2020: The Federal Reserve lowers interest rates to 0% to combat the economic impact of the COVID-19 pandemic. The move helps to stabilize the economy.

Historical Patterns and Trends

Over the past several decades, interest rate changes have followed a general pattern. During periods of economic growth, the Federal Reserve typically raises interest rates to prevent inflation from rising. During periods of economic weakness, the Federal Reserve typically lowers interest rates to stimulate growth.

Projections and Forecasts

Economists and financial analysts are currently forecasting that the Federal Reserve will continue to raise interest rates in 2023. The move is expected to help prevent inflation from rising. However, it could also slow economic growth.

Federal Reserve interest rates have a significant impact on the economy, and as Nancy Mace has pointed out, they can have a particularly pronounced effect on small businesses. The recent increase in rates has made it more expensive for businesses to borrow money, which can slow down growth and hiring.

It is important for the Fed to consider the impact of its decisions on small businesses when setting interest rates.

The Federal Reserve’s interest rate hikes have been a major topic of discussion lately, but they’re not the only thing that’s been making headlines. The recent discovery of a 1971 plane crash in Lake Champlain has also captured the public’s attention.

The crash, which killed all 18 people on board, has been the subject of much speculation and investigation. While the cause of the crash is still unknown, it’s a reminder of the dangers of air travel and the importance of safety regulations.

As the Federal Reserve continues to raise interest rates, it’s important to remember that there are other factors that can also affect the economy.

The recent hike in Federal Reserve interest rates has sent shockwaves through the global economy, with economists predicting far-reaching consequences. In the midst of this uncertainty, one emerging market that has caught the attention of investors is Brazil. With its strong economic fundamentals and a relatively low debt-to-GDP ratio, Brazil is seen as a potential haven for investors seeking refuge from the turmoil caused by the Federal Reserve’s actions.

Here’s a detailed analysis of how the Federal Reserve’s interest rate hike could impact the US-Brazil economic relationship.